BEST OVERALL

Alhisab is an accounting software that is designed specifically for small businesses. It has many features, such as billing, tracking expenses, and managing inventory. It is free to use for small business owners and is designed to be user-friendly and easy to navigate. With Alhisab, small business owners can keep track of their financial information and make informed decisions about the growth and management of their business.

As a small business owner, it can be challenging to keep track of your financial information and make informed decisions about the growth and management of your business. That’s where Alhisab comes in.

Alhisab is an accounting software designed specifically for small businesses. It has many features, such as billing, tracking expenses, and managing inventory. The software is free to use, making it an affordable option for small business owners.

One of the key benefits of Alhisab is its user-friendliness. The software is easy to navigate, with a clean and intuitive interface. This makes it easy for small business owners to input and track their financial information quickly.

Alhisab lets you connect it to other business tools and its core accounting features. For example, you can link your Alhisab account to your payment gateway to easily process transactions and track how much money you make.

Overall, Alhisab is a valuable resource for small business owners looking to manage their financial information and make informed decisions about their businesses. Its user-friendly interface and features make it an excellent choice for small businesses.

Pros and Cons

Pros

Built for small businesses

Invoice Customization Available

Supports multiple currencies

Easy to use, with a straight forward interface

Cons

Time tracking functionality is not included.

Integration with bank accounts is not offered at this time.

Best for Micro-Business Owners

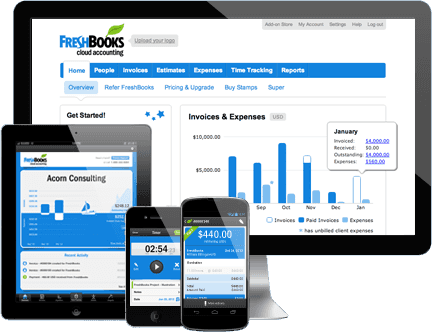

FreshBooks is a financial management software for small businesses that offer invoice, time tracking, project management, expense tracking, and integration with other business tools. It is known for its user-friendly interface and strong customer support.

FreshBooks is a cloud-based invoicing and accounting software designed specifically for small businesses. It has features like tracking time, managing projects, and keeping track of expenses that help businesses manage their money well. With FreshBooks, businesses can easily create and send professional invoices, track the status of their invoices, and receive online payments from their clients.

FreshBooks is known for its user-friendly interface and streamlined workflow. The software is made to be easy to use. It has a simple interface and shows you how to do different tasks. This makes it easy for businesses to get started with FreshBooks and start using it to manage their finances right away.

In addition to its robust feature set, FreshBooks also offers strong customer support. This includes a range of online resources, such as help articles, video tutorials, and customer support via phone and email. This makes it easy for businesses to get help if they have questions or run into issues while using the software.

Pros and Cons

Pros

Built for small businesses

First-class invoice, estimate, and proposal tools

Dedicated project tracking

Friendly Interface

Cons

All plans have client limits

Phone support operates on US business hours

BEST OVERALL

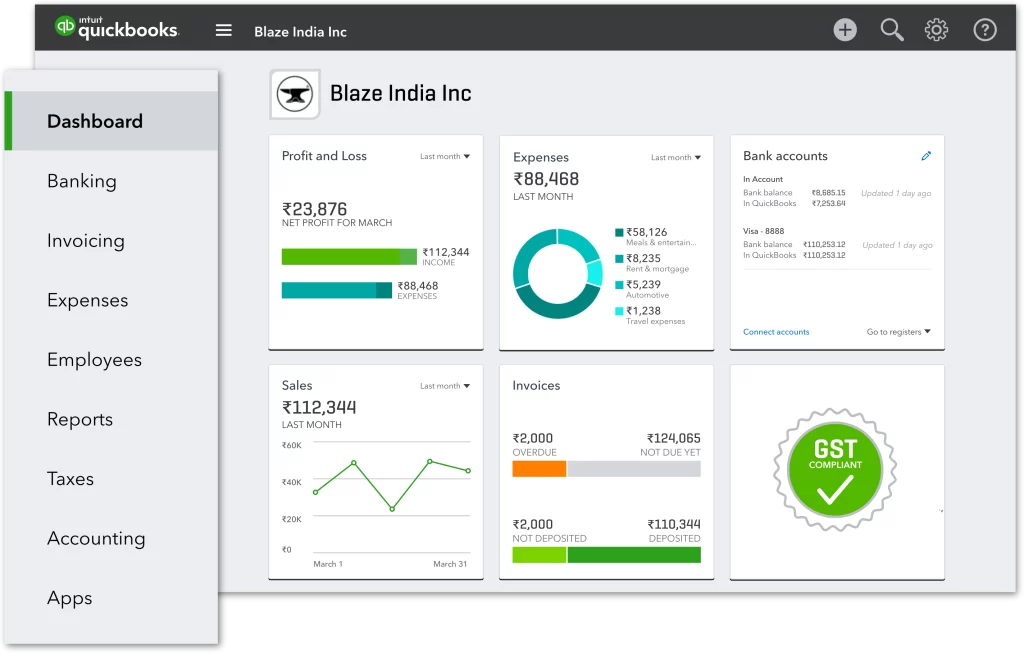

QuickBooks

QuickBooks is a popular financial management software for small and medium businesses because it is easy to use, versatile, customizable, integrates with other tools, and offers strong support options.

QuickBooks is a complete piece of software for managing finances that are made to help small and medium-sized businesses run their finances well. One of the main reasons businesses choose QuickBooks is its ease of use. The software is easy for businesses to use immediately because it has a simple interface and step-by-step instructions for different tasks. QuickBooks is also flexible, with features like invoicing, tracking expenses, and managing inventory. This makes it a good choice for businesses that need an all-in-one way to manage their finances.

Another good thing about QuickBooks is that it can be changed to fit the needs of a business. This includes adding custom fields, creating custom reports, and setting up automated workflows. QuickBooks also works with other business tools, like payment processors, project management software, and CRM systems, which makes it easier for businesses to manage their finances in the context of their overall workflow. Finally, QuickBooks offers strong support options, including online resources, training materials, and customer support, making it easy for businesses to get help if they need it.

Pros and Cons

Pros

Easy to use and learn

Provides good accounting reports

Easy to look-up customer information

Affordable price

Cons

Upgrade required for more users

Occasional syncing problems with banks and credit cards

What is cash management software?

Features of cash management software for small businesses

Automated record-keeping and reporting: One of the key benefits of cash management software is its ability to automate financial record-keeping. All your financial data is stored in one place, making it easy to track and access. In addition, many cash management software solutions come with built-in reporting capabilities, allowing you to generate financial reports with a few clicks of a button.

Budgeting and forecasting capabilities: Cash management software can also help small businesses plan for the future by providing budgeting and forecasting tools. With these tools, you can create financial projections based on past performance and future goals, helping you make informed financial decisions and stay on track with your financial plan.

Invoice management and payment tracking: In addition to tracking your financial performance, cash management software can also help you manage invoices and payments. You can use the software to create and send invoices, track payment status, and set up automated payment reminders to help ensure timely payment from clients.

Real-time visibility into financial performance: One of the biggest advantages of cash management software is its ability to provide real-time visibility into your business’s financial performance. This means you can view up-to-date financial data and get a clear picture of your business’s cash flow at any given moment.

Choosing the right cash management software for your small business

Steps for getting started with a new software system

Please familiarize yourself with the software: Before you start using it, it’s important to take some time to familiarize yourself with its features and functionality. Read through the user manual or attend any training sessions the software provider offers.

Set up your account: Follow the instructions provided by the software provider to set up your account and configure any necessary settings. This may include linking your bank account or setting up integrations with other financial software.

Import your existing data: If you’re switching from a different software system, you’ll want to import your existing financial data into your new software. This can help you better understand your current financial situation and ensure a smooth transition.

Start using the software: Once you’re comfortable with it and have everything set up, it’s time to start using it daily. This may involve entering financial transactions, generating reports, and using the software’s other features to manage your business finances.