The 5 Best Accounting Software in Indonesia

- Best Overall: Alhisab

- Best Free Software: Wave

- Best for Micro-Business Owners: Zoho Books

- Best for Service-Based Businesses: Xero

- Best for Part-Time Freelancers: Quick Books

A cloud-based accounting software made exclusively for small enterprises is called Alhisab. It enables companies to efficiently manage their money, billing, and bookkeeping in a single location. With Alhisab, businesses can forget about setting up and maintaining accounting software on their PCs because everything is securely stored and accessed online. Alhisab provides tools and functions, such as automatic bank reconciliation, tax calculation, and spending monitoring, to assist small firms in streamlining their accounting procedures. Alhisab is a great option for managing your finances, whether you are just starting a company or have been managing a small business for years.

2. Wave Accounting

In terms of features, Wave offers a range of tools for invoicing, expense management, and financial reporting. It also integrates with other business tools, such as point-of-sale systems and project management software, making it easy for businesses to streamline their operations.

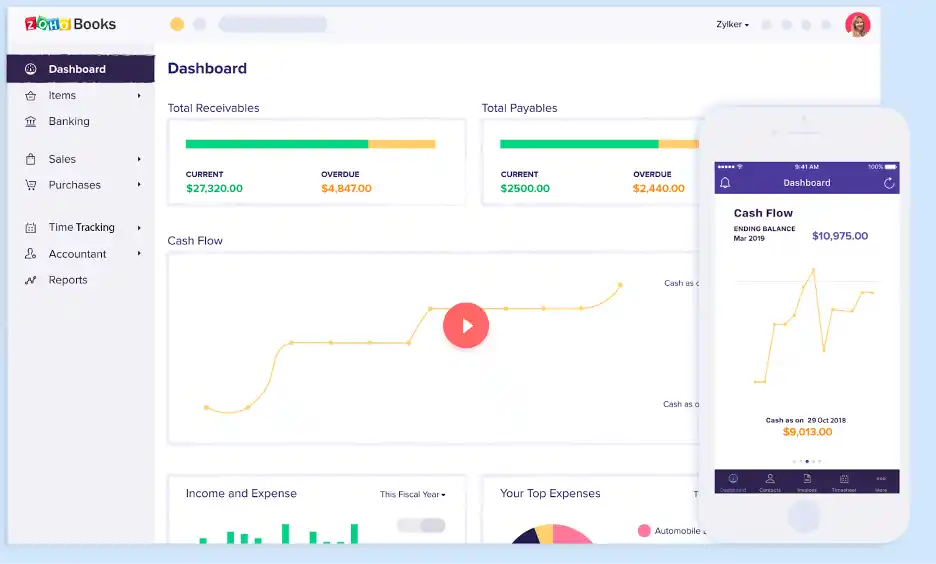

3. Zoho Books

Overall, Zoho Books is a valuable tool for Indonesian businesses looking to streamline their financial management and access real-time financial information from anywhere. Its wide range of features and integrations make it a versatile tool for businesses of all sizes.

4. Xero

Overall, Xero is a valuable tool for Indonesian businesses looking to streamline their financial management and access real-time financial information from anywhere. Its wide range of features and integrations make it a versatile tool for businesses of all sizes.

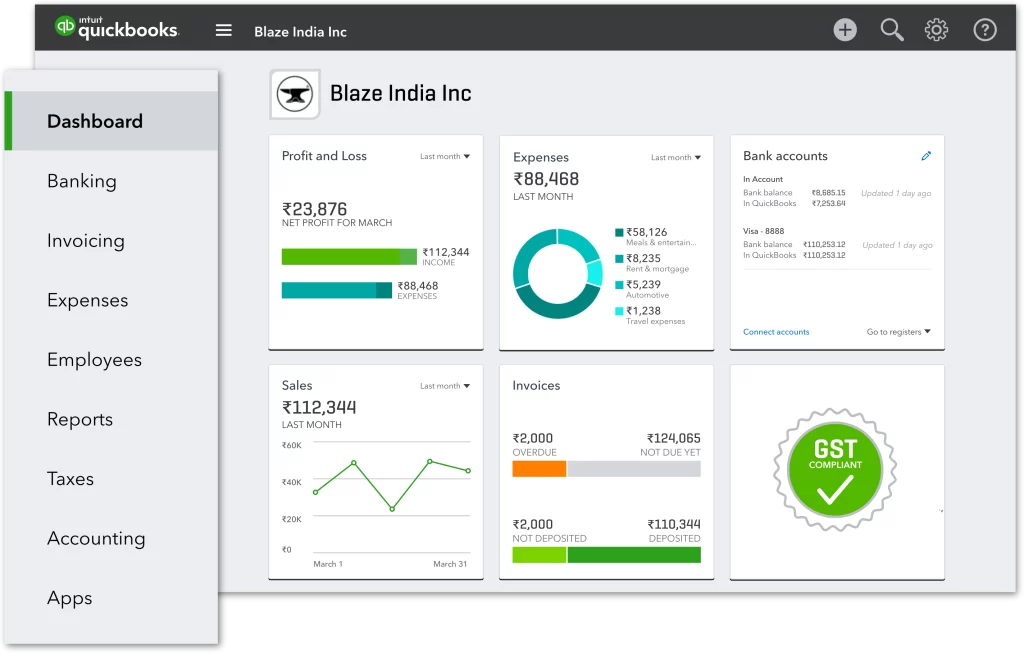

5. QuickBooks

This is a well-known accounting software suitable for small to medium-sized businesses. It offers a range of features, including invoicing, expense tracking, and tax preparation. QuickBooks also has a mobile app that allows users to access their financial data. It is available in Indonesia for a monthly subscription fee.

Understanding the needs of small businesses

- Inability to keep accurate financial records

- Difficulty in managing finances

- Difficulty in generating invoices and tracking expenses

- Difficulty in complying with tax regulations