The 5 Best Accounting Software in South Africa

- Best Overall: Alhisab

- Best Free Software: Wave

- Best for Micro-Business Owners: Zoho Books

- Best for Service-Based Businesses: Cloud Books

- Best for Part-Time Freelancers: NCH Accounting Software

Overview of the South African market for accounting software

The market for accounting software in South Africa is a growing one that is also very competitive. Businesses are becoming more digital and using more technology, so there is a high demand for software that can help them keep track of their financial records and processes in an efficient way. Sage, Xero, Pastel, and QuickBooks are some of the big names in the accounting software market in South Africa.

Alhisab is a comprehensive and easy-to-use accounting software that is popular among businesses and organizations. It has many features that make it an excellent accounting tool for businesses, including the ability to track expenses, income, and assets, generate reports and graphs, and more. The software’s user-friendly interface and clean design make it a great choice for small businesses and organizations.

2. Wave Accounting

If you’re looking for free accounting software that’s easy to use, Wave Accounting is a great option. Its interface is similar to Mint, so you’ll be able to track income and expenses, send invoices, track sales tax, and create reports with ease. Plus, you can run multiple businesses from the same account and check your dashboard to see how the company is doing. Wave Accounting also allows you to collaborate with unlimited partners and accountants, making it a great tool for small businesses.

Wave also has pain plans which start at just $20 per month. With these plans, you’ll get access to powerful features like invoicing, receipts, payment tracking, and double-entry bookkeeping. Plus, Wave Accounting also has a feature called Wave Payroll that allows you to pay employees quickly and easily.

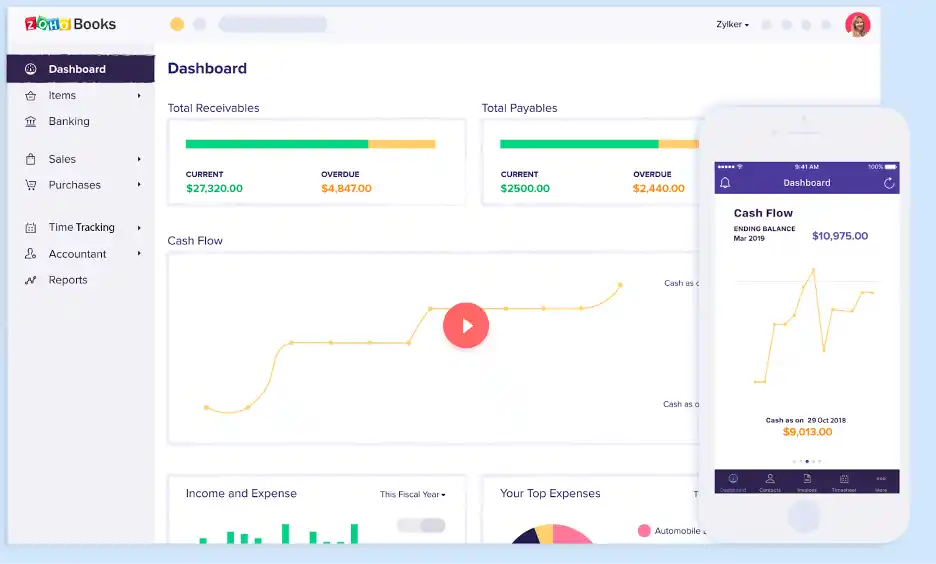

3. Zoho Books

Zoho offers a suite of business software that can help you get your finances in order. The accounting component, Zoho Books, offers features like expense and mileage tracking, reconciliation, invoices, and email support. One of the best things about Zoho Books is that it can integrate with other Zoho products, like Zoho CRM. This makes it a great option if you’re already using other Zoho software for your business.

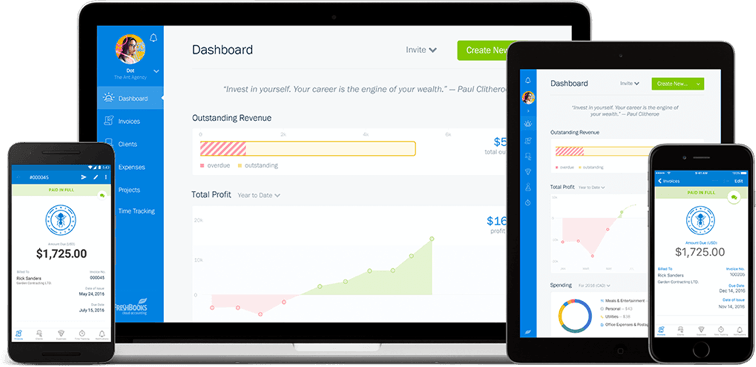

4. CloudBooks

CloudBooks is an accessible accounting software that allows users to add an unlimited number of invoices, create projects, and perform integrated time tracking, expense tracking, and estimation. The free version only allows for five invoices to be sent per month, but the paid versions allow for branding of invoices and online payments.

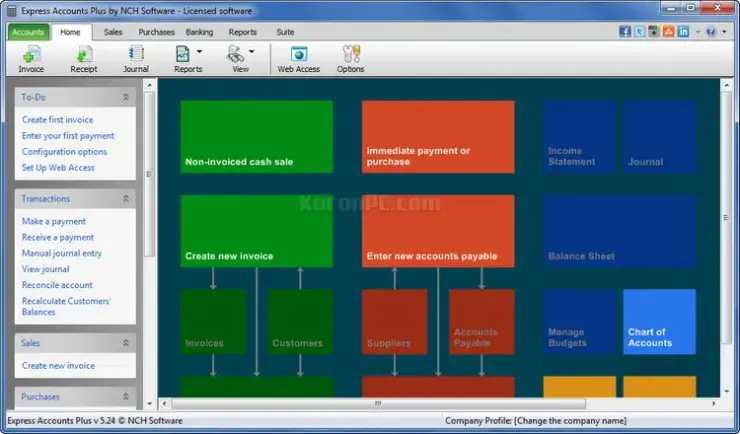

5. NCH Express Accounts

If you’re looking for a free desktop accounting software option, consider NCH Express Accounts. The free version of this software can support the accounting needs of small businesses with fewer than five employees. Through this software, you’ll be able to access and generate 20 crucial financial reports and analyze revenues by customer, team member, or item. You’ll also be able to manage accounts receivable and payable through this software easily. However, to access your books online, you’ll have to purchase the cloud version of Express Accounts, which isn’t free and currently starts at $59.95.

Overview of Accounting Software in South Africa

Here are some factors to consider when choosing Best Accounting Software in South Africa :

Price: When choosing accounting software, price is an important thing to think about. It’s important to know how much money you have and make sure the software you choose doesn’t go over that amount. There are many options, from free to expensive, so you should be able to find something that meets your needs and fits your budget. It’s also important to think about the software’s long-term costs, like subscription or support fees, which can add up over time. It’s smart to do some research and compare prices from different sellers to make sure you’re getting the best deal.

Features: When choosing accounting software, features are another important thing to think about. You should think about the features that are most important to you and your business, such as the ability to make financial statements, track expenses, and manage invoices. Tools for budgeting, managing payroll, and integrating with other business systems, like your CRM or point-of-sale software, are also things to think about. When comparing different software options, it’s a good idea to make a list of the features that are most important to you. Keep in mind that more advanced features may cost more, so you’ll need to think about how much those features are worth and how much money you have.

Integration with other tools: When choosing accounting software, it’s also important to think about how well it works with other tools. If you use other tools in your business, like a customer relationship management (CRM) system or project management software, you’ll want to make sure that the accounting software you choose can work with those tools. This will help you make your workflows more efficient and keep you from having to enter data by hand between different systems. Many kinds of accounting software can connect with a wide range of other tools, so it’s important to take the time to see if the software you’re thinking about has the integrations you need. If your business uses specialized tools, you should check with the vendor to see if there are any integrations you can use.

Ease of use: When choosing accounting software, it’s important to think about how easy it is to use. If the software is too complicated, it might be hard for your team to learn how to use it. This could lead to frustration and less work getting done. On the other hand, easy-to-use and understood software can be picked up quickly and will help your team work faster. When judging how easy it is to use a piece of software, you should look at things like the user interface, the tutorials and documentation that are available, and the overall learning curve. You might also want to think about what kind of help is available, like online tutorials or a customer service team, in case you have any problems.

Security: When selecting accounting software, security is an important factor to take into mind. Your financial information is private and sensitive, therefore it’s critical to secure it from unwanted access and data breaches. Consider aspects like the safeguards in place to protect your data, such as encryption and secure servers, when assessing the security of a piece of software. You should also think about whether the software complies with any pertinent governmental or industry standards, such as HIPAA for healthcare data or PCI DSS for credit card processing. It’s a good idea to ask the seller any questions you may have about the security of the software and to find out what security measures they have in place.

Customer support: Customer support is an important factor to consider when choosing accounting software. Even the best software can have issues or require some form of support from time to time, so it’s important to make sure that you have access to reliable and helpful customer support. There are several things to consider when evaluating the customer support of a software, including the availability of support resources such as online tutorials or a customer support team, the response time of the support team, and the overall level of helpfulness and expertise of the support staff. It’s a good idea to check with the vendor to see what support options are available and to ask any questions you may have about their support process.

Scalability: When selecting accounting software, scalability is an important factor to take into account, especially if you intend to expand your firm in the future. To avoid having to change to a different software in the future, make sure the software you select can scale with you as your business expands. Consider aspects like the maximum number of users, the greatest quantity of data the program can manage, and the product’s capacity to be customized to fit your changing demands when assessing a software’s scalability. If you have any concerns about the software’s scalability, it’s a good idea to speak with the vendor to find out what choices are available for scaling the program.

Mobile accessibility: When selecting accounting software, mobile accessibility is an important issue to take into mind. You may access your financial data while on the go using a mobile app, which is helpful for operating your business from any location. Consider variables including the availability of a mobile app, the functionality it offers, and the app’s general usability when assessing a software’s mobile accessibility. The app’s compatibility with the smartphones and tablets that you and your team use should also be taken into account. It’s a good idea to contact the seller to learn more about the mobile options offered and to ask any queries you might have regarding the software’s mobile usability.

Customization: When selecting accounting software, customization is a significant element to take into mind. Every business is different, thus you can have certain needs or demands for your accounting software that cannot be satisfied by commercially available choices. Consider features like the capacity to design unique reports, the flexibility to alter the user interface, and the availability of APIs or other connectivity options that let you link the software to other systems when assessing a product’s customization choices. It’s a good idea to contact the seller to find out what customization possibilities are offered and to address any customization-related queries you may have.

Industry-specific features: When selecting accounting software, industry-specific features are essential to take into account, especially if you work in a certain area. It may be necessary to adhere to certain rules or laws in some sectors, such as the healthcare or nonprofit sectors. Consider factors like whether the software complies with any relevant and important industry standards or rules and whether it has features unique to your industry, such as payment tracking for healthcare providers or grant management for nonprofits, when evaluating the industry-specific features of a software. Asking the seller any questions you may have about the software’s industry-specific features is a fantastic idea if you want to find out what possibilities are available for your particular industry.

Types of Available Accounting Software in South Africa

Cloud-based accounting software: It’s also known as “software as a service” (SaaS), allows you to access your financial data from any device with an internet connection. This type of software is often subscription-based, meaning you only pay for what you need. Using cloud-based accounting software has a lot of benefits, such as being flexible, scalable, and affordable. With the ability to scale up or down based on your needs, this software is perfect for small or large businesses. Additionally, team members can work together on financial data from any location, making it easier to collaborate and make financial decisions.

On-Premise Software: It’s also known as locally hosted software, is a type of software that is installed and runs on a user’s own computer or local network. This means that it can’t be accessed from the cloud and must be put on each device separately. The IT staff of the user usually manages it. On-premise software is usually more expensive and less flexible than cloud-based software, but it gives users more control and customization options. Before choosing between on-premise and cloud-based accounting software, you should consider your business needs and how much money you have.