The 5 Best Accounting Software for Small Businesses of 2023

- Best Overall: Alhisab

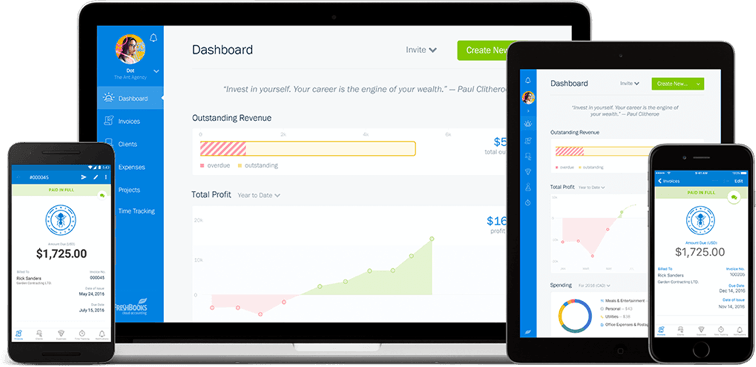

- Best Free Software: < Wave

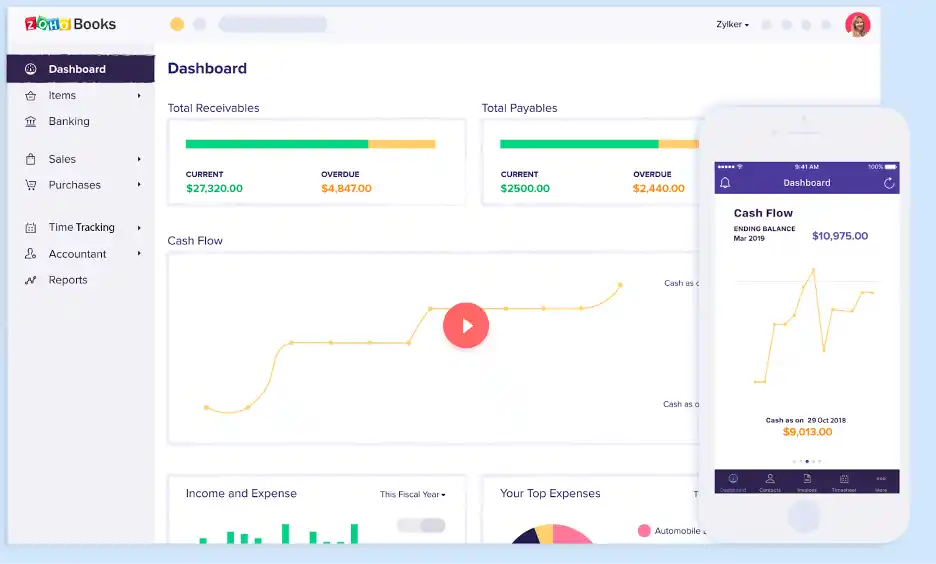

- Best for Micro-Business Owners: Zoho Books

- Best for Service-Based Businesses: Cloud Books

- Best for Part-Time Freelancers: NCH Accounting Software

Features of Free Accounting Software

- Invoicing and billing

- Expense tracking and management

- Bank reconciliation

- Financial reporting and analysis

- Income and expense tracking

- Tax calculation and filing

Alhisab is a comprehensive and easy-to-use accounting software that is popular among businesses and organizations. It has many features that make it an excellent accounting tool for businesses, including the ability to track expenses, income, and assets, generate reports and graphs, and more. The software’s user-friendly interface and clean design make it a great choice for small businesses and organizations.

If you’re looking for free accounting software that’s easy to use, Wave Accounting is a great option. Its interface is similar to Mint, so you’ll be able to track income and expenses, send invoices, track sales tax, and create reports with ease. Plus, you can run multiple businesses from the same account and check your dashboard to see how the company is doing. Wave Accounting also allows you to collaborate with unlimited partners and accountants, making it a great tool for small businesses.

Wave also has pain plans which start at just $20 per month. With these plans, you’ll get access to powerful features like invoicing, receipts, payment tracking, and double-entry bookkeeping. Plus, Wave Accounting also has a feature called Wave Payroll that allows you to pay employees quickly and easily.

Zoho offers a suite of business software that can help you get your finances in order. The accounting component, Zoho Books, offers features like expense and mileage tracking, reconciliation, invoices, and email support. One of the best things about Zoho Books is that it can integrate with other Zoho products, like Zoho CRM. This makes it a great option if you’re already using other Zoho software for your business.

CloudBooks is an accessible accounting software that allows users to add an unlimited number of invoices, create projects, and perform integrated time tracking, expense tracking, and estimation. The free version only allows for five invoices to be sent per month, but the paid versions allow for branding of invoices and online payments.

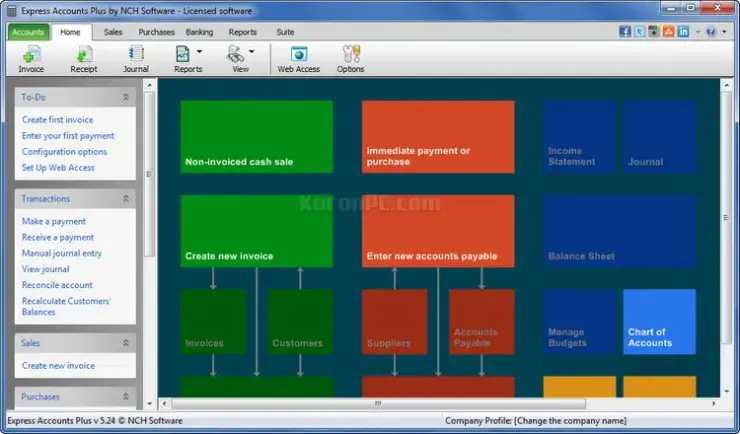

If you’re looking for a free desktop accounting software option, consider NCH Express Accounts. The free version of this software can support the accounting needs of small businesses with fewer than five employees. Through this software, you’ll be able to access and generate 20 crucial financial reports and analyze revenues by customer, team member, or item. You’ll also be able to manage accounts receivable and payable through this software easily. However, to access your books online, you’ll have to purchase the cloud version of Express Accounts, which isn’t free and currently starts at $59.95.

Benefits of using free accounting software for small businesses in the UK include

Cost-effectiveness: One of the most significant benefits of free accounting software is that it is available at no cost, making it an affordable solution for small businesses with limited budgets.

User-friendly interface: Most free accounting software options have a user-friendly interface that makes it easy for small business owners to navigate and use the software without extensive training.

Real-time financial insights: With real-time financial insights, small business owners can stay on top of their finances and make informed decisions quickly and effectively.

Easy integration with other tools: Most free accounting software is easy to integrate with other devices and applications, making the workflow of small businesses more streamlined and efficient.

Because of these benefits, free accounting software in the UK is a good choice for small businesses. It gives them the tools they need to manage their finances well without spending much money.

Importance of Choosing the Right Accounting Software

Cost-effectiveness: One of the most significant benefits of free accounting software is that it is available at no cost, making it an affordable solution for small businesses with limited budgets.

User-friendly interface: Most free accounting software options have a user-friendly interface that makes it easy for small business owners to navigate and use the software without extensive training.

Real-time financial insights: With real-time financial insights, small business owners can stay on top of their finances and make informed decisions quickly and effectively.

Easy integration with other tools: Most free accounting software is easy to integrate with other devices and applications, making the workflow of small businesses more streamlined and efficient.