If you’re running a small business, one of the most important financial reports you’ll ever read is your Profit and Loss Statement (P&L).

Also known as the Income Statement, it tells you whether your business is actually making money or losing it.

In this beginner-friendly guide, we’ll explain what a P&L statement is, why it matters, and how to understand it easily — even if you’re not an accountant.

What Is a Profit and Loss (P&L) Statement?

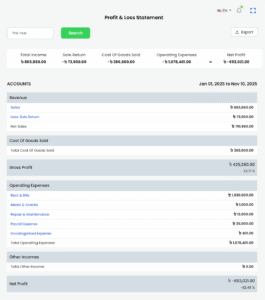

A Profit and Loss Statement shows your total income, costs, and expenses over a specific period — monthly, quarterly, or yearly.

It helps you understand how much profit your business is generating after covering all costs.

In simple terms:

Revenue – Expenses = Net Profit (or Loss)

Main Components of a P&L Statement

1. Revenue (Sales Income)

This is the total income earned from selling goods or services. It’s the top line of your statement and represents how much money is coming into your business.

2. Cost of Goods Sold (COGS)

COGS includes the cost of raw materials, purchase of products, or any direct expenses related to sales.

Subtracting COGS from Revenue gives you Gross Profit.

3. Operating Expenses

These include rent, salaries, utilities, marketing, and administrative costs. Managing these effectively improves profitability.

4. Net Profit (or Loss)

After deducting all expenses, you get the final figure — your Net Profit if positive or Net Loss if negative.

This number shows whether your business is financially healthy.

Why Is the P&L Statement Important?

-

Tracks Business Performance – Helps you see whether your sales are growing and expenses are under control.

-

Guides Decision-Making – You can identify which products or branches are most profitable.

-

Helps Secure Loans or Investments – Lenders and investors rely on P&L statements to assess business viability.

-

Assists in Tax Preparation – A clear profit and loss record simplifies your annual tax reporting.

Common Mistakes to Avoid

-

Not recording all expenses (especially small cash transactions).

-

Ignoring inventory costs when calculating COGS.

-

Mixing business and personal income.

-

Forgetting to update financial records regularly.

Using automated tools like Alhisab ensures these mistakes are avoided — as all income and expense entries flow directly into your reports.

How Alhisab Simplifies P&L Reporting

Preparing a P&L manually can be time-consuming and error-prone.

With Alhisab, your sales, purchases, and expenses are automatically captured and reflected in real-time profit and loss reports.

You can filter results by branch, date, or category — and even export them instantly for review or tax filing.

Simplify your accounting, save time, and make smarter decisions with Alhisab — your trusted accounting and POS solution.