Top 5 Spanish Accounting Software for Entrepreneur in 2023

- Best Overall: Alhisab

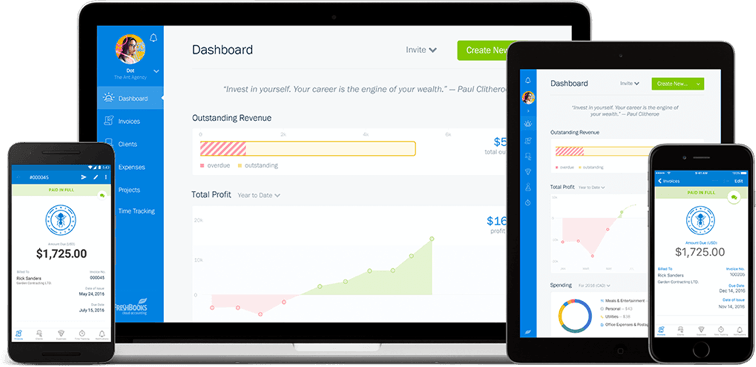

- Best Free Software: Wave

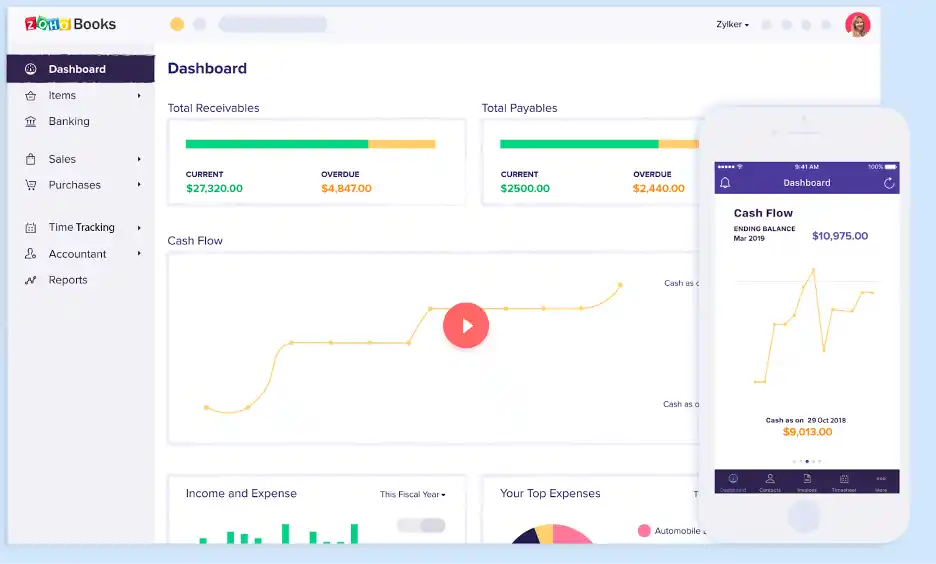

- Best for Micro-Business Owners: Zoho Books

- Best for Service-Based Businesses: Cloud Books

- Best for Part-Time Freelancers: NCH Accounting Software

Alhisab is a comprehensive and easy-to-use accounting software that is popular among businesses and organizations. It has many features that make it an excellent accounting tool for businesses, including the ability to track expenses, income, and assets, generate reports and graphs, and more. The software’s user-friendly interface and clean design make it a great choice for small businesses and organizations.

2. Wave Accounting

If you’re looking for free accounting software that’s easy to use, Wave Accounting is a great option. Its interface is similar to Mint, so you’ll be able to track income and expenses, send invoices, track sales tax, and create reports with ease. Plus, you can run multiple businesses from the same account and check your dashboard to see how the company is doing. Wave Accounting also allows you to collaborate with unlimited partners and accountants, making it a great tool for small businesses.

Wave also has pain plans which start at just $20 per month. With these plans, you’ll get access to powerful features like invoicing, receipts, payment tracking, and double-entry bookkeeping. Plus, Wave Accounting also has a feature called Wave Payroll that allows you to pay employees quickly and easily.

Zoho offers a suite of business software that can help you get your finances in order. The accounting component, Zoho Books, offers features like expense and mileage tracking, reconciliation, invoices, and email support. One of the best things about Zoho Books is that it can integrate with other Zoho products, like Zoho CRM. This makes it a great option if you’re already using other Zoho software for your business.

CloudBooks is an accessible accounting software that allows users to add an unlimited number of invoices, create projects, and perform integrated time tracking, expense tracking, and estimation. The free version only allows for five invoices to be sent per month, but the paid versions allow for branding of invoices and online payments.

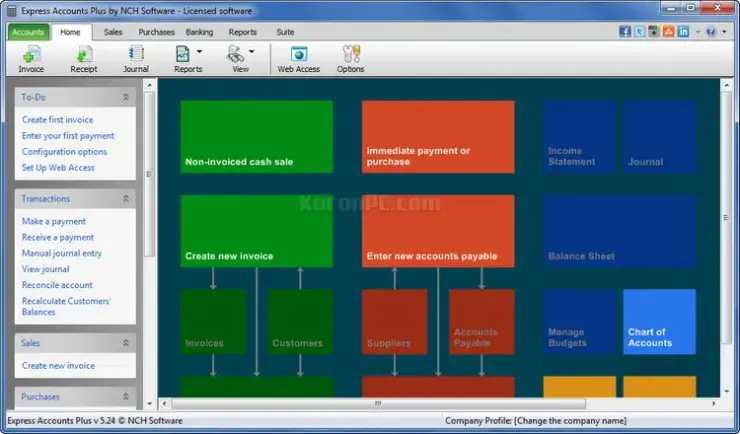

If you’re looking for a free desktop accounting software option, consider NCH Express Accounts. The free version of this software can support the accounting needs of small businesses with fewer than five employees. Through this software, you’ll be able to access and generate 20 crucial financial reports and analyze revenues by customer, team member, or item. You’ll also be able to manage accounts receivable and payable through this software easily. However, to access your books online, you’ll have to purchase the cloud version of Express Accounts, which isn’t free and currently starts at $59.95.

Overview of the Spanish Accounting Software Market

Size and Growth of the Market: The Spanish accounting software market is growing quickly because more and more people want to use digital tools to manage their finances. The market size is estimated to be several billion dollars, with a projected growth rate of 5–10% over the next few years. The growth of the market is due to the fact that small and medium-sized businesses are using technology more and more, and that they need better financial management solutions.

Popular Spanish Accounting Software Options: There are many Spanish accounting software options available in the market. Some of the most popular include Aspel COI, Sage 50cloud Cåomptabilité, SunAccounts, Contaplus, and Nominaplus. The features of these software programs range from invoicing and billing to managing payroll and giving financial reports. Business owners can choose from various options depending on their specific needs.

Accounting Software Types: Accounting software in Spain is broadly classified as desktop-based or cloud-based. Desktop-based software is installed on a local computer and requires manual updates, while cloud-based software is accessed over the internet and is updated automatically. Cloud-based software is getting increasingly popular because it is easy to access and use and can give real-time financial data. Business owners can choose from various options depending on their specific needs and preferences.

Key Features of Spanish Accounting Software

Invoicing and Billing: Invoicing and billing are critical functions of any accounting software, and Spanish accounting software is no exception. These features allow businesses to create, manage, and send customer invoices. They also help companies keep track of customer payments, handle customer accounts, and make financial reports based on billing and invoicing. With Spanish accounting software, these tasks can be streamlined, reducing the amount of work that needs to be done by hand and making the business more efficient.

Payroll Management: Payroll management is critical for any business with employees. Spanish accounting software can help companies handle payroll tasks, such as figuring out employee salaries, making paystubs, and keeping track of payroll taxes. The software can also manage employee information, such as personal details and tax codes, making it easier to run payroll reports and generate financial statements.

Financial Reporting: Financial reporting is a critical function of any accounting software. Spanish accounting software provides businesses the tools they need to generate accurate financial reports, including balance sheets, profit and loss statements, and cash flow reports. This helps companies make informed decisions based on accurate financial data.

Expense Tracking: Spanish accounting software can also help businesses track expenses, including business and personal expenses. With these features, companies can track and organize expenses, such as payments to vendors and costs for employees’ travel and wages. This helps companies monitor cash flow, identify areas for cost reduction, and improve financial reporting accuracy.

Mobile Responsiveness: With the growing use of mobile devices, Spanish accounting software must be mobile-responsive. This allows businesses to access financial data and perform accounting functions from anywhere, at any time, using a smartphone or tablet. This can be especially useful for companies with employees on the go or working remotely.

Messages to customers: Spanish accounting software can also have features that let businesses send messages to customers right from the software. This can be used to send invoices, pay reminders, or answer customer inquiries. This helps companies improve customer communication and increase customer satisfaction.

Better efficiency: By automating many of the manual tasks of managing money, Spanish accounting software can help businesses be more efficient overall. For example, invoicing and billing can be done automatically, saving time and making it easier to track customer payments. Also, the software can manage payroll automatically, which gives businesses more time to focus on other essential tasks.

Accurate financial reporting: Spanish accounting software gives businesses accurate financial reporting, which is essential for making intelligent decisions. The software can create financial reports in real time, so companies can get the most up-to-date information about how their money is doing. This helps businesses find places where they can improve and make decisions based on accurate financial information.

Better Cash Flow Management: Spanish accounting software can help businesses to manage their cash flow more effectively. By tracking expenses and customer payments, companies can better understand their financial position and make informed decisions about managing their cash flow. This can be especially helpful for businesses with a tight cash flow because it lets them decide when to pay their bills and when to get paid.

Time and Cost Savings: Spanish accounting software can help businesses to save time and reduce costs. Companies can save time and effort by automating many of the manual tasks that are part of financial management. Additionally, the software can help businesses reduce their accounting costs by reducing the need for manual labor and improving the accuracy of financial reporting. Companies can improve their financial performance by making financial management take less time and cost less money.

Disadvantages of Spanish Accounting Software

First, Accounting software often offers limited customization options. This can be a problem if your business has unique needs or specific requirements. You may find that the software can’t meet these needs because you can only change it a little.

Second, Accounting software often needs to be better supported. This means that if you have a technical issue or need help with the software, it can take time to get the help you need. This can be especially problematic if you run a business that relies heavily on software.

Finally, Spanish accounting software often comes with a steep learning curve. While it may be simpler and more intuitive than other accounting software, it can still take a lot of time and effort to learn how to use and get the most out of the software. This can be especially true for those new to accounting software in general.