What is Accounting ?

In accounting, financial transactions are recorded, classified, and summarized to provide information that can be used to assist business decisions. Financial decisions can only be made with the help of accounting information. There’s also a debate on Is Accounting Halal ? Accounting provides financial information that is useful for business decision-making. Accounting information can be used to plan, analyze, and make decisions about a business. Accounting is a process, not an end result.

Accounting produces statements. Accountants provide financial information that can be used to manage a business. A financial transaction is recorded to begin the accounting process. Following that, transactions are classified and summarized. Accounting generates information that is essential for making sound financial decisions.

Is accounting halal or Haram

The majority of scholars seem to agree that YES, accounting is halal as long as it is used for legitimate purposes and does not involve any unlawful activities.

However, there are some who argue that accounting is haram because it can be used to deceive people and commit fraud. Ultimately, it is up to each individual to make their own decision on whether they believe accounting is halal or haram.

When Accounting Gets Haram ?

When accounting gets haram, it’s time to reassess your priorities. For Muslims, this means making sure that all financial dealings are in line with Islamic law. This can be a challenge, but it’s important to remember that halal (permissible) and haram (forbidden) are not absolutes. There are many gray areas, and it’s up to each individual to make sure their accounting practices are in line with their own religious beliefs.

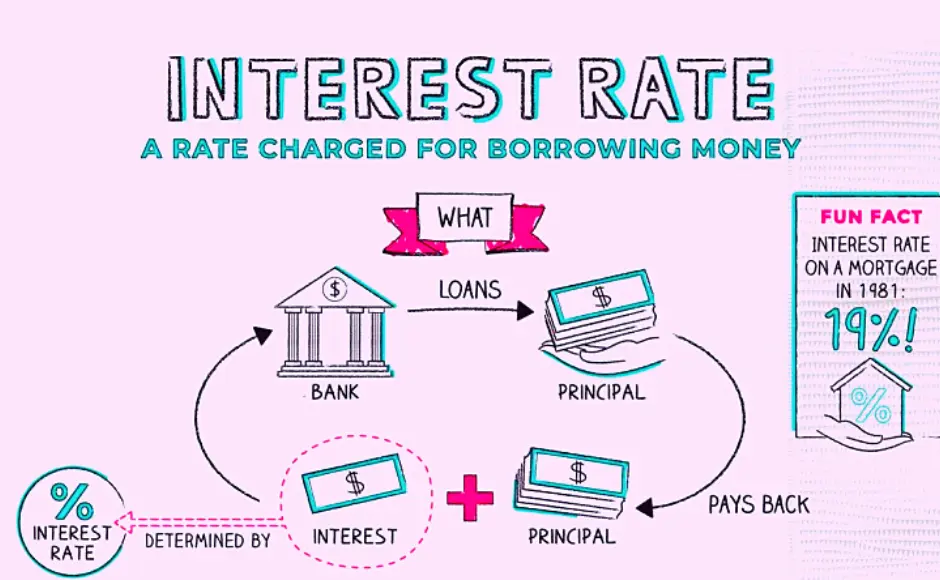

What is Interest ?

Interest is defined as the cost of borrowing money, or the return on an investment. Interest is charged by lenders to borrowers for the use of money, and is paid by investors to savers for the use of their money. The rate of interest is determined by the supply and demand for money on the market.

Why Interest Haram in Islam ?

There are a number of reasons why interest is considered haram, or forbidden, in Islam. First and foremost, Islam teaches that all money belongs to Allah, and that humans are merely stewards of His money. Therefore, it is not right for us to charge interest on money, as we are not the rightful owners of it.

Secondly, charging interest is a form of exploiting the poor and needy. Those who are in need of money are often desperate, and will agree to terms that are not in their best interests simply because they need the money. This is not fair or just, and is therefore prohibited in Islam.

Thirdly, charging interest leads to inflation. When lenders charge interest on loans, borrowers have to pay back more money than they originally borrowed. This extra money then circulates in the economy, leading to inflation. This is harmful to everyone, as it devalues money and makes it difficult for people to afford basic necessities.

Finally, charging interest is simply not in line with the principles of Islam. Islam is a religion of justice and fairness, and charging interest runs against these principles. It is also a form of gambling, which is strictly prohibited in Islam.

For all of these reasons, interest is considered haram in Islam. It is also vital to remember, however, that if someone is in need of money, they should not be denied a loan simply because interest is forbidden. The lender should charge a reasonable fee for the loan, without taking advantage of the borrower’s situation.

What is Islamic Finance?

Islamic finance is a type of financial system based on Islam’s principles. It is a system used to manage money and other assets in a way consistent with Islam’s teachings.

Islamic finance has its roots in the Quran and the Hadith, the two primary sources of Islamic law. The Quran contains verses dealing with economic issues, such as transactions, contracts, and business ethics. The Hadith is a collection of sayings and actions of the Prophet Muhammad that guide how Muslims should live.

Islamic finance is a growing industry estimated to be worth trillions of dollars. It is available in many countries worldwide, including the United States.

There are a few critical principles that Islamic finance is based on:

1) The prohibition of riba: Riba is the Arabic word for interest. Islamic finance prohibits the charging of interest on loans. This is because Islam teaches that money should only be used for productive purposes and not for speculative gain.

2) Risk-sharing promotion: Islamic finance promotes risk-sharing between the lender and the borrower. This is because Islam teaches that it is unfair to place all the risk on the borrower.

3) The prohibition of gambling: Islamic finance prohibits gambling, as it is seen as a form of speculation that is not productive.

4) Promoting ethical and moral values: Islamic finance promotes ethical and moral values, such as honesty, trustworthiness, and fairness.

If you confused about is accounting halal ? then you should know Islamic finance is a growing industry that offers many benefits. It is a fair and just system based on Islam’s principles.

Is being an accountant haram ?

No, being an accountant is not haram. It can be an enriching and fulfilling career.

However, there are a few things to keep in mind when choosing to become an accountant. First and foremost, you must be honest and have integrity. This is extremely important in any career, but especially in accounting. You will be responsible for handling other people’s money and keeping track of financial records, so you must be trustworthy.

Second, you must be diligent and detail-oriented. This is a career where precision is key. You will need to be able to pay close attention to detail to be successful.

Lastly, you must be good with numbers. This may seem like a no-brainer, but working with numbers and having a solid understanding of math is essential. If you need more confidence in your math skills, plenty of resources are available to help you brush up on them.

Overall, being an accountant can be a great career choice. Just be sure to keep the above things in mind, and you’ll be on your way to success.

Halal Careers in Accounting and Finance

There are many halal careers in accounting and finance. You can work in various roles with the right qualifications and experience, including auditing, taxation, financial planning, and investment banking.

There is a growing demand for halal-compliant financial services, and many accounting and finance professionals are choosing to specialize in this area. With a strong understanding of Islamic financial principles, you can help businesses and individuals make sound financial decisions according to their beliefs.

If you’re interested in a career in accounting and finance, consider studying for a professional qualification such as the Chartered Accountant (CA) or Certified Financial Planner (CFP) designation. You can build a successful career in this exciting and growing industry with the right skills and knowledge.

Discovering the 4 Types of Accounting

If you’re in business, you need to know the different types of accounting and which one is right for you. Here’s a quick rundown of the four main types of accounting:

1. Financial Accounting: Financial Accounting is the type of accounting that deals with the financial statements of a business. This information is used by external users like creditors, investors, and tax authorities.

2. Managerial accounting: This type of accounting provides information to internal users like managers and decision-makers. Managerial Accounting can use to make pricing, inventory, and production decisions.

3. Cost accounting: This type of accounting tracks the costs of making and selling products. Cost Accounting can use this information to make pricing, production, and inventory decisions.

4. Auditing: This is the type of accounting that ensures the accuracy of financial statements. External users like creditors and investors rely on audited financial statements.

Conclusion

In conclusion, If you have query is accounting halal ? YES, accounting is halal according to Islamic law. This means that it is permissible for businesses to use financial accounting methods (such as profit and loss statements) in order to report the performance of their businesses in a way that conforms with Islamic principles.